Source: PA Photos

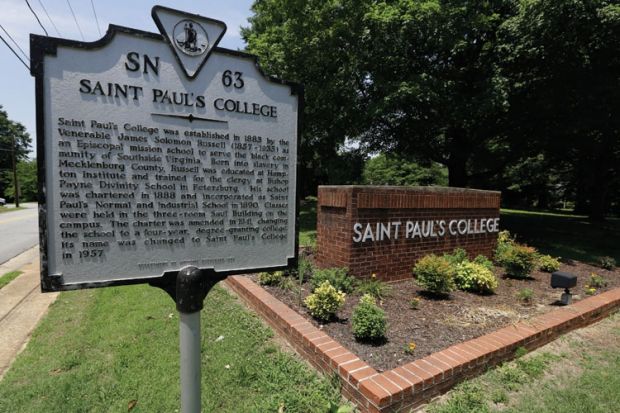

Historical marker: Saint Paul’s College, hit by financial problems and falling enrolments, closed after more than a century of teaching and training. Some observers fear that more institutions could face the same fate

Saint Paul’s College in rural southern Virginia would normally be teeming with students this autumn. Instead, its red-brick buildings are empty and abandoned, its once-green lawns are patchy brown, its students are scrambling to transfer to other universities, and its faculty and staff are looking for new jobs and fretting about their pensions.

The 125-year-old private, not-for-profit institution did not reopen for the new academic year after struggling with financial problems and dwindling enrolment. By the time it finally staggered to a close – and despite desperate appeals to donors and alumni for money – it was down from nearly 600 students to only 111.

This is a sad story, but not an isolated one. Experts, including financial analysts and bond rating agencies, warn that more US universities will close. In addition to Saint Paul’s, at least five others have shut over the past two years, in Massachusetts, Mississippi, Nebraska, New Hampshire and Tennessee. As many as a third of institutions are on an unsustainable financial path, according to the consulting firm Bain & Company, based on an analysis of some 1,700 US colleges and universities. Its report, The Financially Sustainable University, says their debts are ballooning while revenues are flat.

In response to the closing of Saint Paul’s, the credit rating agency Moody’s Investors Service said: “We anticipate more closures for these types of colleges given the current pressures on all higher education revenue sources.”

The risk is greatest for small private, not-for-profit universities – typically called colleges in the US – that are religiously affiliated, have a single-sex student body, paltry endowments and tuition fees so high that students and their families no longer think them worth the price. Saint Paul’s, for example, was predominantly black and Episcopalian.

Meanwhile, after years of growth, enrolment overall is shrinking. That is because America’s university-age population is declining from its 2011 peak, and because the slowly recovering economy is luring some prospective students into jobs instead of university. The number of students at US universities dropped by 2.3 per cent in the spring (compared with the previous spring), according to the National Student Clearinghouse, having already fallen by 1.8 per cent last autumn (compared with the previous autumn). At more than half of institutions, enrolments have stagnated or declined, the National Association of College and University Business Officers (Nacubo) reports – and a third of those by a significant, budget-busting 5 per cent or more.

“It’s definitely a transition point for a lot of those mid-tier colleges,” says Jason Lane, director of education studies at the Nelson A. Rockefeller Institute of Government at the University at Albany, State University of New York. “It’s very significant. It’s borderline dire for some of them. Many of them are already in fiscally questionable positions and significantly dependent on tuition [fee] dollars. They’re all going to be competing for the same enrolment, and there’s not going to be enough enrolment to go around.”

Damaging discounts

To fill seats, cash-strapped universities are already being forced to dole out increasing proportions of their tuition fee revenue in the form of institutional grants. This price cut, called the “discount rate”, reached a record-high average of 45 per cent last year, up from 34 per cent 10 years before, according to Nacubo. That means almost half of institutions’ revenue went straight back out the door, even before the first penny of salaries or other costs were paid. So while the cost of tuition appears to be rising faster than inflation, actual revenues are short of the inflation rate, and universities are falling further and further behind. Eighty-seven per cent of first-time students last year were given some form of institutional grants, cutting what they paid by 53 per cent below advertised prices.

“It’s a pretty tough financial model,” says Jack Wilson, distinguished professor of higher education, emerging technologies and innovation at the University of Massachusetts Lowell. “There’s significant cause for concern for the smaller colleges. We’ve already seen a number of them that have gone out of business. I think that trend is likely to continue or accelerate. It’s not really the size that makes the difference. It’s the economic model, the way the college is financed.”

A third of universities forecast that, this year, their revenue from tuition charges will grow by no more than 2 per cent – short of the inflation rate – or even decline, Moody’s says. It warns that smaller, lower-rated, fee-dependent institutions are most at risk.

The small private universities are also dealing with intensifying competition from lower-priced public universities.

In addition to cutting their rates, nervous not-for-profit private universities are taking other steps. One, Hope College in Michigan, will pay half the cost of air travel, as well as meals, accommodation and transport to and from the airport for prospective applicants who visit the campus. Others in slow-growing parts of the country are recruiting at a frenzy in states whose university-age populations are continuing to grow. Such activities, however, have pushed private universities’ recruiting costs to $3,043 per student (£1,905), up 42 per cent in the past five years, according to the National Association for College Admission Counseling.

A few are taking far more drastic action. Several women-only colleges have invited men to apply. Other private universities have joined forces to survive. City University of Seattle agreed to be absorbed into the larger, not-for-profit National University System, which has also merged with John F. Kennedy University, WestMed College and others, expanding programme offerings while centralising administrative functions to cut costs. (A last-ditch plan to combine Saint Paul’s with another Episcopalian campus failed.)

“There will be two [universities] that look absolutely identical, and one will survive and even thrive under strong leadership while the other will go out of business under weak leadership,” says Jack Maguire, a higher education management consultant. “There are going to be consolidations, there are going to be mergers, and then there’s going to be the kind of weak leadership that puts third- and fourth-tier schools out of business.”

Private, not-for-profit universities are also reaching out to adult learners, says David Warren, president of the National Association of Independent Colleges and Universities, by offering degrees and money-making professional qualifications programmes at night and at the weekends.

“There’s no question that the convergence of demographic, marketplace and economic trends is shaking the status quo,” says Warren, who disputes that the problem is as bad as some have suggested. “While no one can deny the challenges that exist, it is far too early to predict the demise of any group of private institutions…There will continue to be demand for a diverse marketplace of institutions that serves many different niches.”

Slow to face facts

But observers say that many private, not-for-profit universities – not particularly nimble at the best of times – have failed to respond to the danger they now face.

“It’s easy to manage when everything’s golden and you have unlimited resources,” Lane says. “Those [universities] that find ways to change and adapt are going to be successful, and the reality is that there are some that are going to have to close.”

Moody’s, in a report, pointed out disapprovingly that, even in the depths of the economic downturn, less than 30 per cent of private universities cut their operating costs.

“I don’t think all is lost,” says Heather O’Leary, principal analyst at consulting firm Eduventures. “But these universities are going to have to change not only how they do business, but how they communicate their value to prospective students and their parents. Parents and students understand that college is going to be an investment, and they’re willing to make that investment if they feel the return is going to be worth it.”

However, O’Leary says, everything institutions talk about relates to the cost of college. “Their value proposition is, ‘We’re going to make college affordable for you.’ Which is not the same thing. So are we coming to a tipping point where the market is going to shake out some of those schools whose business model is not just sustainable? Yes, some schools will probably suffer and find themselves out of business.”

Register to continue

Why register?

- Registration is free and only takes a moment

- Once registered, you can read 3 articles a month

- Sign up for our newsletter

Subscribe

Or subscribe for unlimited access to:

- Unlimited access to news, views, insights & reviews

- Digital editions

- Digital access to THE’s university and college rankings analysis

Already registered or a current subscriber? Login