Chile has historically had one of the most market-driven university systems in the world, with the vast majority of costs borne by students. But then, in 2011, a wave of student protests began that, on occasions, saw more than 100,000 take to the streets of Santiago. The protesters caught the world’s attention with their demands for an end to tuition fees and for-profit higher education as a remedy for high levels of social inequality: demands that were sometimes met with tear gas and water cannon from riot police (to which some students responded with rocks).

“Tuition-free university education will make Chile a more just and supportive country for all,” said Chile’s president, Michelle Bachelet, late last year, after a law was passed granting access to free education for students from the poorest 50 per cent of families. The previous president, conservative Sebastián Piñera, took a battering in the wake of the student protests and lost the 2014 election to the socialist Ms Bachelet, elected on a pledge to transform education.

The protests were a tumultuous reminder of the worldwide political potency of the issue of higher education costs and who bears them. Nor is Chile alone in tipping the balance away from the private financing of higher education in recent years. All of Germany’s federal states have ended brief experiments with tuition fees, and enormous protests in the Canadian province of Quebec against plans to increase tuition fees – then set at C$2,168 a year (£1,049) – by 75 per cent over six years led to the fall of the provincial government and a much more modest rise in fees linked to living costs.

But another current in global higher education is towards greater private contribution towards higher education costs. In the vanguard of that movement is, of course, England, which has recently trebled undergraduate fees and slashed public funding for teaching. It could also be joined by Australia (see 'Australia: a changing landscape' box, below), whose Liberal-led government may still press ahead with plans to lift caps on tuition fees despite the failure of previous prime minister Tony Abbott to get the measure through the country’s parliament.

But which of these opposing currents is likely to prevail? How should nations determine who should bear the cost of higher education? And is it possible to calculate an optimum balance between public and private funding?

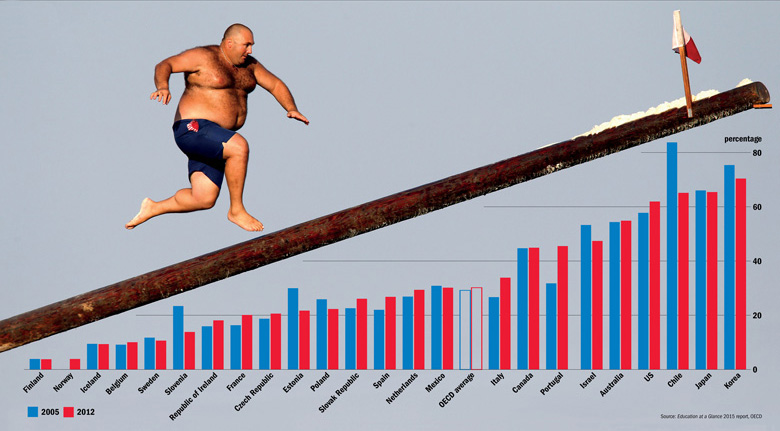

The latest edition of the Organisation for Economic Cooperation and Development’s annual Education at a Glance report reveals that between 2000 and 2012, “the average share of public funding for tertiary institutions [in 20 OECD member nations] decreased from 68.8 per cent in 2000, to 64.9 per cent in 2005 and decreased slightly again to 64.5 per cent in 2012”.

According to the OECD, the balance is tilted furthest towards individuals in South Korea (where 70.7 per cent of tertiary education funding came from private sources in 2012), Japan (65.7 per cent), Chile (65.4 per cent), the US (62.2 per cent) and Australia (55.1 per cent). The UK’s proportion was only 43.1 per cent. But this highlights the complexity of the funding balance, particularly when income-contingent loans are involved. In the OECD figures, the bulk of Australia’s student loans are classed as private. Yet England changed its classification in the latest data collection, meaning its fee loans are now classed as public funding – despite the trebling of fees.

The nations where the balance is tilted furthest in the opposite direction, towards public funding, are Finland (96.2 per cent), Norway (96.1 per cent), Austria (95.3 per cent), Luxembourg (94.8 per cent) and Iceland (90.6 per cent).

Of course, the question of how higher education is funded is more complex than a simple public-private binary divide. Other crucial issues include whether tuition fees are paid up front or after graduation via income-contingent loans, whether “sticker prices” on fees are subsidised by governments and whether there is grant or loan support for student living costs.

But the OECD gets to the nub of the basic question in Education at a Glance. “More people are participating in a wider range of educational programmes offered by [more] providers than ever before,” it says. “As a result, the question of who should support an individual’s efforts to acquire more education – governments or the individuals themselves – is becoming increasingly important.”

The OECD notes that “some policymakers assert that those who benefit the most from education – the individuals who receive it – should bear at least some of the costs”. The net financial return from higher education for individuals, in terms of higher earnings, averages $145,200 (£102,600) over a lifetime for women and $229,000 for men across the developed economies the OECD tracks. Net public returns – via factors such as greater tax revenues – are calculated as $65,500 for women and $127,400 for men.

But is the OECD right to say that the individuals who go through higher education are the ones who “benefit most”? Walter McMahon, emeritus professor of economics at the University of Illinois at Urbana-Champaign, looked at this question in his 2009 book Higher Learning, Greater Good: The Private and Social Benefits of Higher Education.

The book represented the first significant attempt to put a monetary value on the social benefits produced by higher education, and to weigh those against the individual returns gained through higher earnings. McMahon defined a set of “private non-market benefits” as including “own-health, spousal health, children’s health, children’s schooling, children’s cognitive development, happiness, and longevity”. Meanwhile, social benefits from higher education included “the operation of civic institutions essential to democracy, human rights, and political stability, as well as contributions to the operation of the criminal justice system, to crime reduction, to poverty reduction, to environmental sustainability, and to the creation and dissemination of new knowledge”.

Using US data, he calculated that 52 per cent of the benefits from higher education are private non-market and social, with 48 per cent private in the form of higher earnings. On that basis, he argued that the split between public and private funding for higher education should be on the same 52:48 ratio.

McMahon also calculated that the value of the private non-market and social benefits returned by higher education (the social rate of return) to be about 41 per cent of the cost of providing it; this is a way of comparing investment in higher education to other financial assets with returns.

Such a figure makes higher education “a very good investment”, McMahon tells Times Higher Education. “And to cut back on public investment, as states are doing in the US and as the Cameron government is doing in [England], is extremely short-sighted. It slows growth in the future, not immediately. Politicians tend to be myopic and short-sighted, unfortunately.”

McMahon sees his calculations on the private non-market and social benefits as highlighting an important issue: “On average, and in the longer run, households and students will tend to underinvest” in higher education, given that they may not be able to discern these benefits – or at least not discern them as having arisen from higher education.

So “from an economic point of view, there is a below-optimal level of investment when the benefits are partly social like that,” McMahon says. “The economist’s remedy for this must be a subsidy of some kind. These [non-market and social benefits] are the benefits that must be subsidised if there is to be an optimal level of outputs of higher education and the benefits that flow therefrom.”

But McMahon adds that given there are private benefits “it is appropriate to charge some tuition and get some resource recovery…from well-to-do parents that otherwise would not be contributing to the costs”, while the combination of public and private support also increases funding per student and “provides better quality education”.

The US has deviated too far from the optimal 52:48 public-private ratio, according to McMahon. “In recent years, the states have been withdrawing their public support for higher education. This is really a tragedy because it means that tuition [fees] have skyrocketed and the private/public ratio is much more on the private side,” he says.

Andreas Schleicher, the OECD’s director of education, says that “what is very clear is that the private returns [from higher education] are very high – and that the fiscal benefits are very high. So it’s good business for both individuals and governments.”

Moving on up: proportion of private expenditure on tertiary education

But he differs from McMahon on public funding and its uses, rejecting the idea that there is any ideal balance between public and private funding. “For me, it’s not a question of what the proportion [of public funding] is, but of how the public money is used to maximise participation by the most able people,” he says. On that measure, he says, the US is “a rather bad example” – an assertion with which even President Obama might agree given his own concerns about the spiralling cost of higher education in the US. Countries with income-contingent loan systems, such as the UK, Australia and New Zealand, are “more positive examples in the sense that less public money is used more effectively to give those people with the best prospects of making a big contribution to the economy the best possibilities”.

In Schleicher’s view, it is perfectly possible to “have a system that is heavily biased towards private financing and is still fair and equitable” and that still provides a reasonable rate of return for individuals. However, he cautions that “it is not a good choice for governments to get out of this market – like the Japanese or the Koreans are doing – [because] you lose out on the fiscal returns. It’s a very good investment that society makes.”

He also emphasises the importance of focusing on the value of social benefits derived from higher education. “We are beginning to get interesting data on this,” he says. “It’s not just health and the more obvious things: it’s the relationship between the skills of people and the [level of] trust in society: social cohesion. That makes the question of who pays for the benefits much more difficult to answer. What you can say for sure is that the fiscal and private rate of return will underestimate the return of education to society.”

As economists will know, the talk of “rates of return” employed to differing ends by McMahon and Schleicher comes from human capital theory – arguably the most influential economic theory in education policy since the 1960s. Milton Friedman offered an influential definition of human capital in his 1955 essay, The Role of Government in Education. He called vocational or professional education “a form of investment in human capital precisely analogous to investment in machinery, buildings, or other forms of non-human capital. Its function is to raise the economic productivity of the human being.”

Simon Marginson, professor of international higher education at the UCL Institute of Education, applauds McMahon’s success in “putting externalities and public good benefits on the agenda”. But, of his specific calculations, he notes that “all national policy calculations of public/private shares of benefit and, thus, cost are arbitrary and assumption-driven. We have no way of accurately calculating [the value of] externalities because they don’t enter a market or a public budget – shadow prices are guesswork.”

He also points to the question of “whether public and private benefits are additive or zero-sum”. For example, it might be that more public spending on better buildings in universities increases both the individual and social returns from higher education.

More broadly on human capital theory, Marginson argues that graduate earnings “are strongly affected – and in some cases largely determined – by factors other than higher education, such as social background and networks and schooling”. So rates of return “are not necessarily rates of return to education”, says Marginson, which amounts to a “substantial problem for human capital theory”. He says it is “amazing that human capital theory is still used in some countries to set tuition [fees]”, noting that private earnings are “wheeled out as the scientific rationale for policy when tuition [fees] goes up” in England and Australia.

His personal view on funding trends in world higher education is that “in the longer run, the private proportion of funding will keep on increasing, provided mechanisms like income-contingent loans are used. This is because of the sociopolitical logic of mass higher education. Once enough of the middle-class families are enrolled in higher education, everyone has to be there. The penalties attached to non-participation are too great, unless you are very rich.”

Bahram Bekhradnia, president of the Higher Education Policy Institute, has advised governments from nations as diverse as Indonesia and Chile on their higher education policies in work for the World Bank. For him, asking whether nations can ever find an optimum balance of public and private funding is “not a very sensible question”. This is because “even if you were able to calculate the relative benefits [to individuals and society] precisely, that would still not tell you what proportion should be publicly funded”. He adds that in order to achieve the public benefits it wants, a government “might need to invest more than its ‘share’” of the benefits owing to factors such as market failure or risk aversion among individuals.

Bekhradnia agrees with Schleicher that “one of the great advantages of the income-contingent loan arrangement we have had in England since 2006 – and in Australia for much longer – is that it uses public funds to unlock private funds”. But he argues that “to use public funds exclusively – or very largely – simply to subsidise loans, rather than fund universities directly, is daft, and the mess that we are in with the present arrangements [in England] shows one of the reasons why: the government has no idea what the level of subsidy will be”. The Westminster government’s estimates on the future repayment levels of graduates have fluctuated as the state of the economy has varied, meaning that “we don’t actually know what the balance between public and private contributions will be”.

As for what the right balance is, Bekhradnia says that “this is not just or even very largely a matter of economics. It is about ideology and politics as well. Those countries with extreme right-wing ideologies (Pinochet’s Chile, Abbott’s Australia, Cameron’s England) have reduced the public contribution and rely increasingly on fees (or, in Australia’s case, they intend to do so). Those with left-wing (not always extreme left-wing) governments have sought a different balance.”

The OECD’s figures demonstrate this: the highest levels of private funding are found in low-tax “new world” societies (such as the US and Australia) and in East Asia, where societies are often family-oriented and may have little or no tradition of welfare states. The highest levels of public funding are found in the high-tax social democracies of the Nordic and other continental European nations.

In terms of the argument for sustained or increased public funding, Marginson notes that currently “no concerted attempt is being made to measure the value of public benefits in economic or social terms, though there is no shortage of rhetoric about public benefits”. But this needs to change if “we want to increase [public benefits] and distribute them democratically so they are not unduly captured by the upper middle class”.

Schleicher seems to share some of the same goals in measuring social benefits. But the OECD, and Schleicher in particular, are influential advocates for the use of income-contingent loans worldwide, and the march of human capital theory, with a focus on graduate earnings for the time being, is likely to continue.

Indeed, in England the government is making progress in its attempts to link reliable data on individuals’ graduate earnings with their student loan records – potentially giving information on earnings and loan repayment rates by institution and by course. There are suggestions that institutions judged to be good performers on these metrics could in future be allowed to raise fees, which would open up a new frontier in human capital theory’s application to education policy.

As for Bachelet, she has vowed to continue progress towards making higher education entirely free for all Chileans, such that “an individual’s education will depend on their intelligence and work and not the size of their family’s bank account”. Economics is one thing, but, on the fraught issue of tuition fees, passions and politics can sometimes take nations in less predictable directions.

-

To read students' views on the issue, click here

Chile: can the nation bankroll its ambitions?

In the eyes of some, Chile’s move towards greater public funding of higher education marks the end of a 30-year era that began under military dictator Augusto Pinochet.

That argument portrays Chile as a country “where the increase in university tuition has reached the limit of what the public will tolerate [and] where the most deliberate and comprehensive university privatisation experiment in the world was carried out”. That was the message, for instance, of a 2015 paper written by Cristina González, a professor in the School of Education at the University of California, Davis, and Liliana Pedraja of the University of Tarapacá, Chile.

Michelle Bachelet, Chile’s president, has successfully pushed through a move granting free higher education to students from the poorest 50 per cent of families. This was a scaling back of her original election pledge for universal free university education – others in government had concerns about the cost – but she hopes to extend her new policy before her term ends in 2018.

Andrés Bernasconi, vice-dean of the School of Education at the Pontifical Catholic University of Chile, is unsure that will happen, noting that Chilean public finances are “very tight because of macroeconomic conditions and the plummeting price of copper”, the country’s main export.

He acknowledges that if the 50 per cent policy “means more students are going to be debt free or…are not going to face a difference between the [value] of their scholarship and the [cost] of their tuition”, that “moves in the direction of greater [social] equality”.

However, he says that the law “won’t fundamentally alter the proportion of funding in higher education that comes from private sources versus public sources” because the students eligible for the new scholarships and subsidised loans constitute a “rather small” proportion of Chile’s 1.2 million students, probably amounting to no more than 200,000.

And low levels of prior educational achievement mean that “the really poor students do not have a chance of getting into a university in Chile. At best they will go to a technical training centre.” And, those, so far, will continue to charge tuition fees to everyone. So, for that matter, will most universities – only Chile’s 25 public and traditional private universities, plus five more recently established private institutions, will initially be covered by the new policy.

“Proponents of tuition-free higher education refer to education as a ‘social right’, by which they mean…the public benefits outweigh the private benefits of higher education and, therefore, the case can be made that more public funding is warranted,” Bernasconi says.

“People on the right, however, and most economists, would argue that the private benefits outweigh the public benefits and, therefore…some level of tuition payment is just and healthy for the overall sustainability of the system.

“That discussion is more or less still going on – [but its] importance is really limited by the fact that there is no money.”

John Morgan

Australia: a changing landscape

Australia, already one of the developed nations with the highest proportions of private funding for higher education, has the potential to shift even further in that direction should plans to deregulate fees go ahead.

Although the plans were shelved by new prime minister Malcolm Turnbull after they ran into political opposition under his predecessor Tony Abbott, they are still thought to be on the agenda for the Liberal-led government.

At present, annual fee caps range from A$6,256 to A$10,440 (£3,068 to £5,120) depending on the course studied. Under deregulation, it is expected that fees for domestic students would be limited to the level charged to overseas students. In 2016, the University of Melbourne will charge overseas students annual fees ranging from about A$26,000 in performing arts, up to A$76,000 in medicine.

Bruce Chapman, a professor of economics at the Australian National University and the architect of the country’s income-contingent student loans system, says that neither economists nor anyone else can specify what the “right” level of charges should be.

“We know that the private rate of return [from higher education] is high on average, which justifies a charge, but because there are [also] ‘externalities’ (social spillovers) there should be a subsidy as well, implying that the charge should be less than the recurrent costs [of running the course]. Beyond that, we don’t know what the right subsidy should be and no empirical work (of which I have done a lot) can resolve this.”

He adds that he is “comfortable” with the roughly 50 per cent of recurrent costs currently charged to Australian students.

“I believe that if full fee deregulation were to go ahead the charges would end up being too high here. But that is an ethical judgement, not a perspective informed by data or theory,” he says.

Andrew Norton, higher education programme director at Australia’s Grattan Institute thinktank and a former adviser to the previous Liberal-National government, notes that the balance of public and private spending on higher education in each country generally reflects “broader patterns of taxation and social spending”. He does not believe that “the public benefits associated with higher education in themselves justify public spending”, arguing that Australia “could spend much less than it does now on tuition subsidies and still get the same public benefits”.

“Even quite high fees are still going to be good value for most students,” he says, noting that income-contingent loan schemes “provide some financial protection for students and graduates whose higher education investment does not pay off, at least in monetary terms.”

“As was the case in England, the push for lower tuition subsidies here is driven by government budgetary problems,” he observes. “But given that our history and international experience suggests that cuts can be made with few adverse educational consequences, it is not surprising that governments are considering spending less on higher education.”

John Morgan

POSTSCRIPT:

Print headline: A delicate balance

Register to continue

Why register?

- Registration is free and only takes a moment

- Once registered, you can read 3 articles a month

- Sign up for our newsletter

Subscribe

Or subscribe for unlimited access to:

- Unlimited access to news, views, insights & reviews

- Digital editions

- Digital access to THE’s university and college rankings analysis

Already registered or a current subscriber? Login