Attempts by “rogue” recruitment agents to get round UK visa rules by lending money to students on a very short-term basis are “commonplace” and it is an area needing “considerable attention” from the immigration authorities, according to a former universities minister.

Lord Johnson of Marylebone also called on the UK to have a “willingness to learn from other countries” on managing the risks from such practices so they did not damage the UK’s international education strategy.

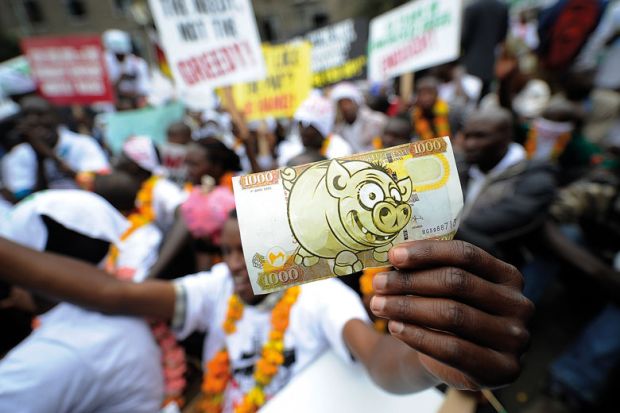

One recent report, in The PIE News, suggested that there were agents in Nigeria openly offering to provide students with funds to meet UK visa rules on proving they have enough money for a course and living costs.

While there is no evidence that such activity has led to widespread abuse of the system, concerns could grow over such practices, especially since the latest statistics showed visa grants reached a record level last year.

Lord Johnson said the recent “welcome growth” in international student numbers had to go “hand in hand with measures to maintain confidence in the integrity of our visa system”.

“That is essential if we are to avoid a policy whipsaw in reaction to evidence of fraud and abuse,” he told Times Higher Education.

Lord Johnson added that “fraudulent practices by rogue agents providing funds on a very short-term basis in order to assist students in demonstrating they have the funds to support themselves in the UK, and possibly recycling the same funding to assist multiple students, are commonplace”.

“This is an area that requires considerable attention from UKVI [UK Visas and Immigration] and also a willingness to learn from other countries that have put in place mechanisms to manage this risk.”

In particular, he urged the UK to consider adopting a model similar to that used in Canada, where visas can be fast-tracked if students buy a “guaranteed investment certificate” from a recognised bank to prove they have a certain level of funds. Such a system was highlighted as a key measure to tackle fraud in a recent report led by Lord Johnson on boosting recruitment from India.

“A scheme of this sort would significantly de-risk the UK’s international student recruitment,” Lord Johnson said.

The latest UK immigration figures also showed a tripling in visas issued to students’ dependants. Although this is a category that still represents only a small share – about 10 per cent – of all study visas, there may be concerns that growing numbers could be seized upon by opponents of student migration.

Nick Hillman, director of the Higher Education Policy Institute, said the UK should “of course welcome [dependants] with open arms when their presence is within the rules.

“But this is also one area among many where constant vigilance is necessary to ensure the rules are fair and are being applied equitably and also where we need to ensure that people are not misusing them.”

Anne-Marie Graham, chief executive of the UK Council for International Student Affairs, said although the country was in a “positive place for international recruitment”, the sector was “keenly aware that immigration policy can change quickly” and so had “already taken steps to minimise the risk of future shifts”.

This included working “closely with UKVI and other government departments to share data and learn from trends”.

A Home Office spokeswoman said “robust measures” were in place “to prevent abuse of the student visa application process, including training for our decision-makers on detecting forgeries and the ability to interview applicants to help question their credibility and intentions”.