If the devil was in the detail of the hard-fought, last-minute deal to reduce US federal spending by trillions of dollars, there was an angel looking out for higher education.

In 11th-hour negotiations last week, budget-cutters unexpectedly spared the nation's principal financial aid programme for undergraduates, Pell Grants, despite widespread speculation that its huge price tag made it an obvious target.

But to do that, higher costs were placed on graduate and professional students, who typically already leave with crushing debts.

Billions in spending for university research is also on the chopping block, and the reprieve for Pell Grants may only be temporary.

"We are not claiming victory and going home," said Stephanie Giesecke, director for budget and appropriations at the National Association of Independent Colleges and Universities. "We made it through this impasse and we're joking about doing our Christmas shopping now, because it's going to be a busy autumn."

Only hours before the US was due to default on its debts, and after a long and fiercely partisan battle, the White House and Congress finally reached a deal last week to cut $1 trillion (£612 billion) over 10 years from the federal budget.

A committee has also been tasked with finding another $1.5 trillion in savings by November. If it fails, cuts of that amount will be triggered automatically across the board.

That is when Pell Grants' luck is likely to run out.

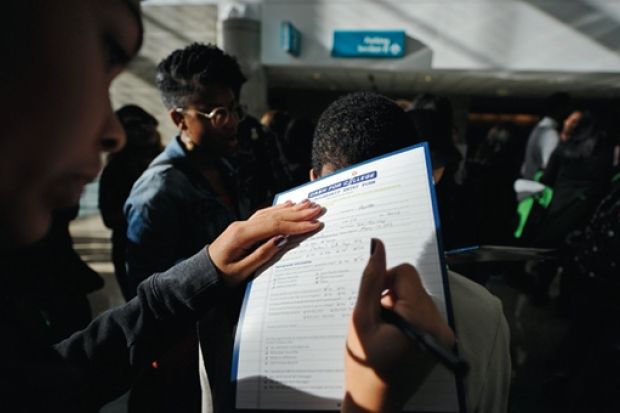

While the programme, which provides tuition grants to 10 million low- and middle-income students, enjoys bipartisan support, it has grown enormously, as university costs increased faster than inflation and the number of families who met the income requirements soared.

After taking 35 years to reach $15 billion, the annual cost has more than doubled in the past four and now stands at $37 billion.

The sums involved make it hard for the budget-cutters to ignore. "If you're going to make cuts in federal spending, you have to go where the money is," said Virginia Foxx, the Republican chair of the House higher education subcommittee.

Until two weeks before the debt deal, higher education lobbyists were resigned to the idea that the programme would be cut by as much as one-third. Even the White House, which had been a staunch supporter, said it needed to be reined in.

"When they said we have to reduce spending on this programme, everyone in higher education thought, 'We've got a big problem'," said Terry Hartle, senior vice-president for government and public affairs at the American Council on Education.

But then, in the midst of the acrimonious debt debate, both parties put out competing plans with almost identical language calling for Pell Grants to be preserved, signalling that the White House and Congress had agreed in private to save them for now.

Republicans like the programme because it puts money in the hands of students without restricting their choice of university. Democrats support it because it serves mostly people with incomes of $40,000 a year or less.

Still, the deal whittled away at the costs involved.

Only a year after allowing Pell Grants to be used by students enrolled in summer terms - a change that was meant to help them get through their education more quickly - Congress removed that provision, saving $4 billion a year.

It also revised a key term of government-subsidised loans for students in graduate and professional schools.

Today the government pays the interest on loans while students are still at university, a practice that will end next July, saving $18 billion over 10 years.

This will mean the average professional or graduate student will have to pay an additional $7,000 in interest. Already, law students finish university with an average of $91,500 in loan debt and medical students $158,000 - with almost a third owing more than $200,000.

Other cuts will shift more of the burden for education to states, which have already cut spending on universities by a collective $5 billion.

And some $30 billion a year now allocated by Washington for university research and development is also vulnerable. "Almost all of the federal R&D funding comes out of the domestic discretionary side of the budget, and that is the side of the budget that just got hit with a baseball bat," Dr Hartle said.

"It will be very difficult for Congress to maintain funding for all the things they're doing now, even very popular things."